personal customers, globally

business customers, globally

countries and regions supported

in-app currencies supported

Our global mission is for every person and business to do all things money — spending, saving, investing, borrowing, managing, and more — in just a few taps.

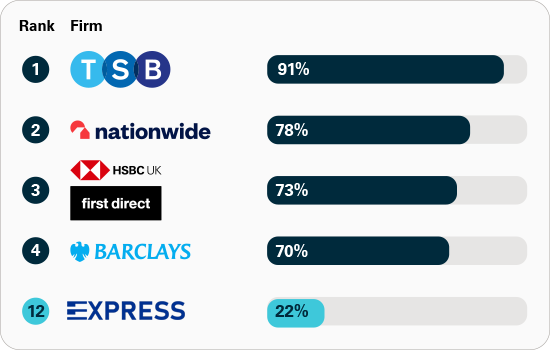

Money matters are complicated. Whether it’s sending money abroad, balancing your family’s budget, or scaling your business — we’ve all experienced how fractured and frustrating finances can be. That’s why we’re here. Express exists to remove the friction that stands in the way of your money goals becoming your new reality.

We’re building a platform so effortless, so seamless, so borderless that you’ll never want to use another financial app again. And we’re making it happen by doing what we always do: relentlessly delivering faster, better, smarter products.

- Fund Rise planning - £ 25M - Releasing in 2026 - Launch as a Express first super bank in United Kingdom and Bangladesh

- Ideas invested - Planning a team - Next generation super banking App - Come accross to create revolution in digital finance

Discovered a team - Market study - Digital Finance analysis last 4 years - Comes together to build an innovative team

The Group Board of Directors are responsible for setting the overall strategy and culture of the Express Bank, and for overseeing management in its day-to-day running of the business.

The Board is also responsible for ensuring the Group has in-place governance arrangements, as well as policies and practices appropriate for the size and nature of Express’s business.

Get to know our global leadership team who steers our Dream Team, and how Expressbank.uk applies the spirit of the Corporate Code Principles within our Corporate Governance Framework in United Kingdom.

Sasagawa is the Chairman and Founder of Express and a co-founder since starting the company with James Murray. With an impressive 25+ years career in the Japanese banking sector, Sasagawa has gained extensive experience in various financial offices. After many years in the international forex market and money exchanges, utilizing AI-based technologies, Sasagawa dedicated his efforts to developing an all-in-one super finance application. This innovative app aims to streamline daily financial management for British people, offering a trusted and comprehensive banking solution.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Anand has been serving as Express’s Chief Technology Officer since the company with James Murray & Sasagawa . With extensive experience in software engineering across various sectors such as social and finance, he has developed database warehouse systems and social apps. Over his 12+ years at top-tier banks and IT companies, Anand has built financial software systems, leading him to recognize the need for a next-generation digital super banking service. He holds a degree in computer science and has key skills in AI and data warehouse applications.

James is the Vice President of Express and a co-founder since starting the company with Anand Bhandari. With an impressive 15+ years career in the UK banking sector, James has gained extensive experience in various financial offices. After many years in the international forex market and money exchanges, utilizing AI-based technologies, James dedicated his efforts to developing an all-in-one super finance application. This innovative app aims to streamline daily financial management for British people, offering a trusted and comprehensive banking solution.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Nitesh has been the Branch Manager of the India Branch for over 11 years. During his tenure, he has overseen a total RA portfolio exceeding USD 12 billion and deposits of over USD 6 billion. Prior to this role, he served as an Branch Manager for several years and worked as a Senior Auditor at Stafin Capital. Nitesh is a Chartered Accountant (CA) from the Institute of Chartered Accountants of India and holds an MBA in Finance. He joined Express with a strong dedication to his work.

Sending money abroad or sticking to a budget with built-in tools, no matter your needs, get more from your money with our Student account.

Enjoy extra perks like priority in-app support and everyday spending protection, for less than the price of a coffee. All this and more, with Silver.

Discover flexible benefits that fit your life at home, and take you all over the globe. Save, spend, send, and invest smarter with Gold.

Enjoy higher limits on investments and more, and explore an array of lifestyle enhancing benefits, all on Metal.

You’re the boss. Set limits, track, freeze/unfreeze and decide where cards can be used. Expenses automatically remind staff to submit receipts; it’s bookkeeping made easy

Experience the exceptional, featuring exclusive lifestyle benefits, world-class travel, and a precision engineered, platinum-plated VIP Premium card.